Award-winning PDF software

Declaration Pursuant To California Probate Code §13100-13115: What You Should Know

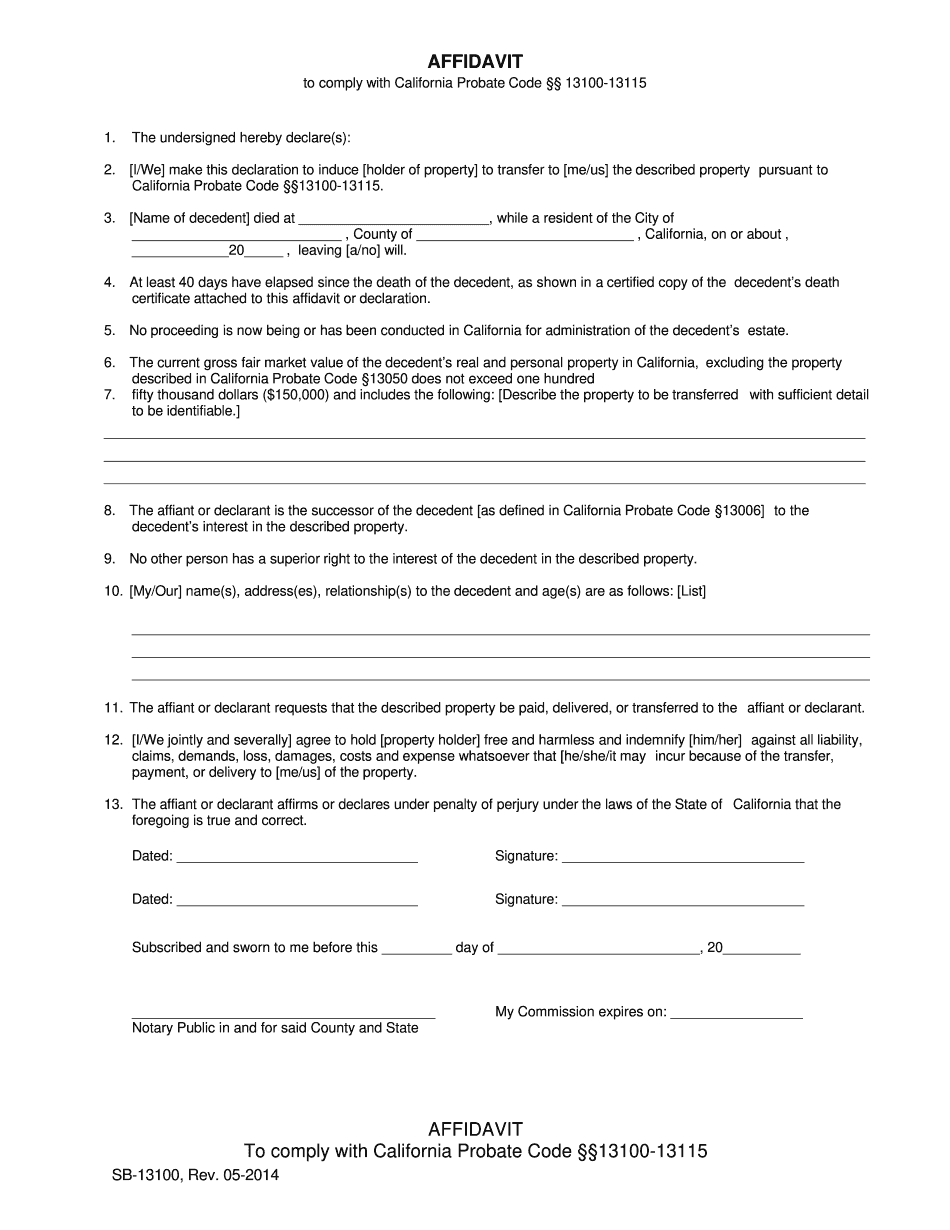

The described property pursuant to California Probate Code § 135 2. Since [deceased] has not been declared a surviving estate, all title to the property is hereby transferred to [me/us], subject to the condition that the property be treated as personal property. 3. The decedent was entitled through a will to bequeath all the following: a. [Property] to me and to any [other] descendants of the decedent. The terms “descendants,” “descended from the decedent,” and “any descendants of the decedent” have the same meaning as in Cal. Probate Code §135. 4. [I/We] make this statement so that [him/her][them/hers] estate tax returns will reflect the change in the beneficiary of the estate. 5. [This statement is signed by the Personal Representative and, depending on the information furnished by the decedent's surviving spouse or survivors, the Estate Tax Return.] California Probate Code §135 6. The California Probate Code, §135, is hereby amended as follows: Cal CPR §13101. (A) A surviving spouse receives 10 per beneficiary from intestate succession with respect to the decedent's will. Cal CPR §13102. (B) The tax on the estate shall be: 1. [This tax is payable by the estate tax return of.] (a) [Personal Representative] if they are required by §13118(a) to file a tax return. 2. [The Estate Tax Return, if applicable.] if they are not required by §13118(a) to file a tax return. Cal CPR §13116. The tax shall be assessed against the estate at its valuation as if it were personal property. Cal CPR §13110. (C) [If applicable, estate tax returns may be filed] The tax shall be applied against the estate on the estate tax return. Cal CPR §13125. (D) The heirs of the decedent or other beneficiaries of the estate may make application to the court to waive the tax. An executor who receives an estate tax waiver application from a beneficiary must notify the Estate Tax Return, if applicable, and send a copy of the waiver application to the other heirs and beneficiaries of the decedent.

Online methods make it easier to to prepare your document management and supercharge the productiveness of your workflow. Observe the short information to be able to full Declaration Pursuant to California Probate Code §13100-13115, refrain from errors and furnish it in a very timely fashion:

How to complete a Declaration Pursuant to California Probate Code §13100-13115 on the internet:

- On the website while using the type, click on Initiate Now and move to your editor.

- Use the clues to complete the related fields.

- Include your own facts and phone data.

- Make convinced that you enter suitable facts and numbers in suitable fields.

- Carefully verify the subject matter from the kind also as grammar and spelling.

- Refer to assist segment when you've got any concerns or address our Service team.

- Put an digital signature with your Declaration Pursuant to California Probate Code §13100-13115 with the support of Indication Tool.

- Once the shape is accomplished, push Completed.

- Distribute the prepared sort through e mail or fax, print it out or help you save on your equipment.

PDF editor will allow you to make adjustments to the Declaration Pursuant to California Probate Code §13100-13115 from any online world connected gadget, customize it in accordance with your preferences, sign it electronically and distribute in different approaches.