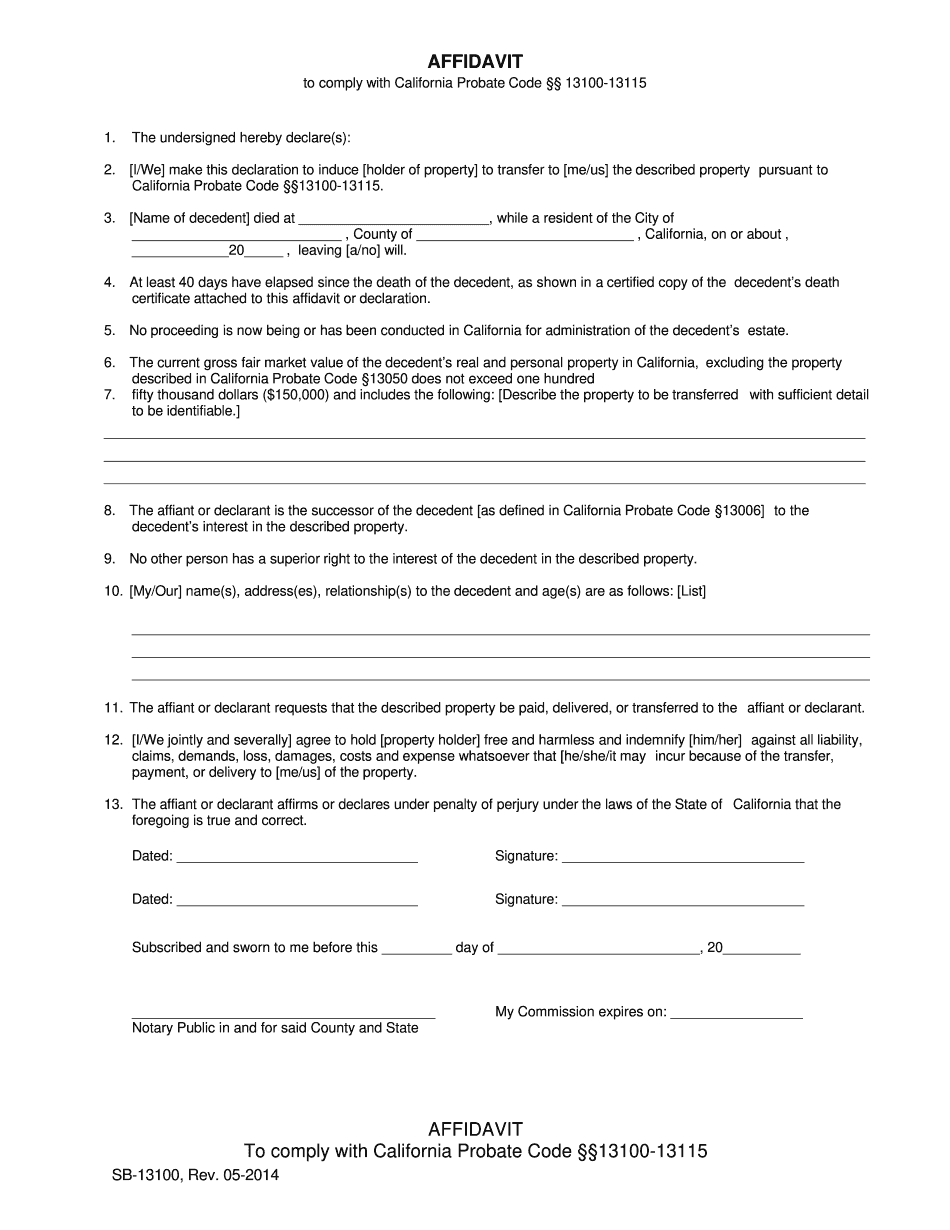

In the cases where the total personal property assets that need to be transferred in a decedent's estate are worth less than $100,000, California has a simplified procedure for beneficiaries to take ownership of them. This procedure is available whether or not a decedent had a legally valid will or trust. In calculating the hundred thousand dollar limit, assets that would otherwise avoid probate are also excluded. So, in other words, assets held in a trust, a joint tenancy account, life insurance paid directly to a beneficiary, and the like are not counted when totaling the aggregate fair market value of the decedent's assets that need to be below $100,000 in order to fit within this exception. If an estate's assets do qualify for this summary procedure, though, an affidavit must be prepared and sworn to by the beneficiary of those assets. One thing to recognize is if you want to use this procedure, you should know that there is no requirement to notify the decedent's creditors like there is in appropriate proceedings. However, to the extent that you receive property, you may be liable for the debts of the decedent that arise in the future. At any rate, after 40 days from the date of the decedent's death has elapsed, the beneficiary fills out the affidavit. That form is then used to actually change the name on the decedent's assets. So, for example, if the decedent had an account at a bank, the affiant beneficiary simply takes the affidavit to the bank and changes the title on the account with it. Finally, it's important to point out that in addition to the summary procedure outlined here for small estates, a couple of other summary procedures exists for transferring property. For instance, you can transfer real property that is worth less than...

Award-winning PDF software

California probate code 2025 PDF Form: What You Should Know

Dissolution of Marriage Dec 18, 2025 — (Prob. Code, § 1561.6.) DIPLOMATIC DECLARATION TO DISSOLVE MARRIAGE. THE STATE DECLARES THAT A WIFE WHO DOES NOT WANT TO RESIDE WITH HER FELON SON OR CHILD IN THIS STATE WILL, WITHIN ONE WEEK FROM THE EFFECTIVE DATE OF THIS DECLARATION, HAVE AN OPPORTUNITY TO SIGN AND FILE THIS STATUTE AND TO WAIVER THE CIVIL PENALTIES THAT GO WITH THE DECLARATION. DATED February 3, 2011. PROBATE PRACTITIONER FORM PAGE 1 OF 7. PROBATE PRACTITIONER FORM. Probate Code — PROB. DIVISION 4.10. PERSONS PROSTITUTING PROBATE PRACTITIONERS. SEPTEMBER 1, 2025 — (Prob. Code, § 1596.7.) PROBATE PRACTITIONER REFERENDUM. NOTICE THAT DECEMBER 19, 2017, THE STATE REPUBLICAN PARTY WILL NOT VETO THE ADOPTION OF THIS LEGISLATION IN THIS STATE. NOTICE TO Tenant AND PARENTS PROBATE PRACTITIONER STATUTE FORM PAGE 1 OF 7. PROBATE PRACTITIONER STATUTE FORM. Probate Code — PROB. DIVISION 4.11. FELON PROBATE. THIS FORM MUST BE COMPLETED AND SIGNED BY THE BOARD OF PROBATES AT OR BEFORE THE TIME THEY DECIDE ON PROBATE PRACTITIONER CONSIDERATIONS. THE PROB LIC NOTICE REQUESTED AND OBTAINED FROM THIS FORM SHALL BE CONSIDERED WITH RESPECT TO ACCEPTING THE DECLARATION OF THE FELON'S PROBATE. (Prob. Code, § 1596.3, § 1603.) FORM OF APPROVAL OF PROBATE PRACTITIONER.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing California probate code 2025 PDF