Thank you for watching our YouTube channel. Today's episode is going to be on funding your trust. Many times, when individuals establish their living trust to avoid probate, they don't get the appropriate advice to transfer particular assets into the living trust. So, what we want to do is talk about the assets that need to be transferred in and the importance of doing so. Certain probate triggering assets are real estate holdings and bank accounts. When we talk about bank accounts, when you add up the cumulative value of all the accounts spread across the checking, savings, and brokerage accounts (non-retirement accounts), if that balance exceeds $150,000, then you would have a probate on the financial assets. So, when we talk about bank accounts, we're looking at a threshold of about $150k. When it comes to real estate holdings, you're going to have probate on those assets. So, when we talk about real estate and bank accounts, those are your probate triggering assets, and we need to make sure that those assets get funded or transferred into the name of your trust. What happens when you do not transfer these assets into a living trust? God forbid, you pass, and your successor trustee will make his way over to the bank and tell the bank to release those funds. Unfortunately, since the accounts were not part of the trust, the bank will not release those funds to the trustee. They're going to say that these accounts never made their way over into the living trust by title. Please go to court and get the court's permission to have those accounts transferred into the trust. Now, the problem here is we were going to have to go through the probate process, and that was the whole purpose of setting up...

Award-winning PDF software

Cost of small estate affidavit in california Form: What You Should Know

HSA section of this blog for tips Form 1096 Estimated Distributions if Over the Expected Tax Rate, if over the tax payment due date This Form shows whether you can be over the tax payment due date. May 6, 2025 — I received 1096 from smart for 50,000 account with a balance of 20,000 Sep 3, 2025 — I received 1099-SA from smart for 3,250 in my account as expected Apr 15, 2025 — I received a 1099-SA for 6,250 on my account Sep 21, 2025 — I received 1099-SA from health, and it was received before the 1096 from smart Corrected 1099-SA with corrected 1096 Sep 6, 2025 — I received 1099-SA and corrected it back to the correct amount — 5,000 Feb 1, 2025 — I received corrected 1099-SA and now know it was 4,250 for my account Sep 3, 2025 — I received a 1099-SA with corrected 1096 and now know it was 2,250 for my account Nov 29, 2025 — I received corrected 1099-SA and now know 1,000 more is expected in this case. May 24, 2025 — I received 1099-SA and corrected it back to 1,500 for this year Sep 5, 2025 — I received corrected 1099-SA and now know 500 more isn't expected of this case Sep 25, 2025 — I received corrected 1099-SA and now know 500 more is expected of this case Feb 6, 2025 — My account showed 1,000 and corrected it back to 500 Aug 18, 2025 — My account shows 1,000 and corrected it back to 0 Dec 1, 2025 — My account shows 1,000 and corrected it back to 500 July 2, 2025 — It shows 0 in the account, but was supposed to be 0 Dec 22, 2025 — It shows 0 in account and corrected it back to 50 Feb 1, 2025 — My account shows 0 and corrected it back to 50 May 6, 2025 — My account shows 0 and corrected it back to 50.

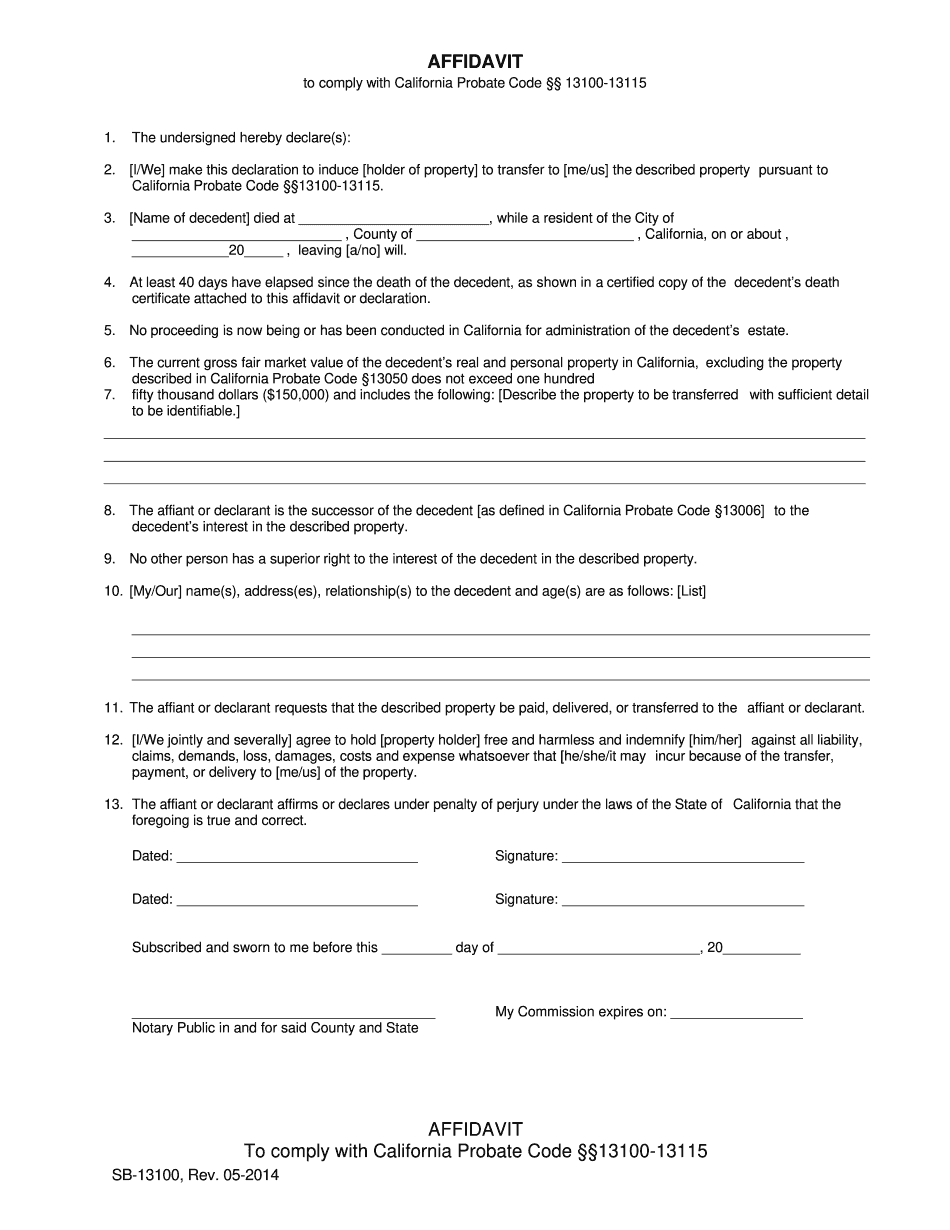

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cost of small estate affidavit in california