Music in Arizona, you are not required to file a probate if your estate only involves personal property, bank accounts, or vehicles with a collective total value of under $75,000. So, if you have a $5,000 bank account, the courts and legislature do not want you to go through a full-blown probate process just 30 days after death. Small bank accounts, personal property collections, coin collections, and car via car titles can be collected by an affidavit without the need for probate. If you have a vehicle, the Motor Vehicle Division has its own affidavit of collection of personal property. You can go to the vehicle division and fill out that affidavit, and they will sign over the car to the heirs without the need for probate. The $75,000 limit is collective. This means that if you have assets such as one bank account for $50,000 and another one for $30,000, and a car, then you would have to file probate. However, if you have a $50,000 account and a $20,000 vehicle, you do not have to file a probate. The person who is entitled to those assets can collect the account through an affidavit of collection of personal property. There is a statute, RS 1430 971, that allows the rightful heirs to collect assets in small estates without going through the probate process. If you are looking for an Arizona attorney to handle your estate planning, trust administration, guardianship, or probate, call us today at 520-622-0400 or visit us online at elderlaw.com.

Award-winning PDF software

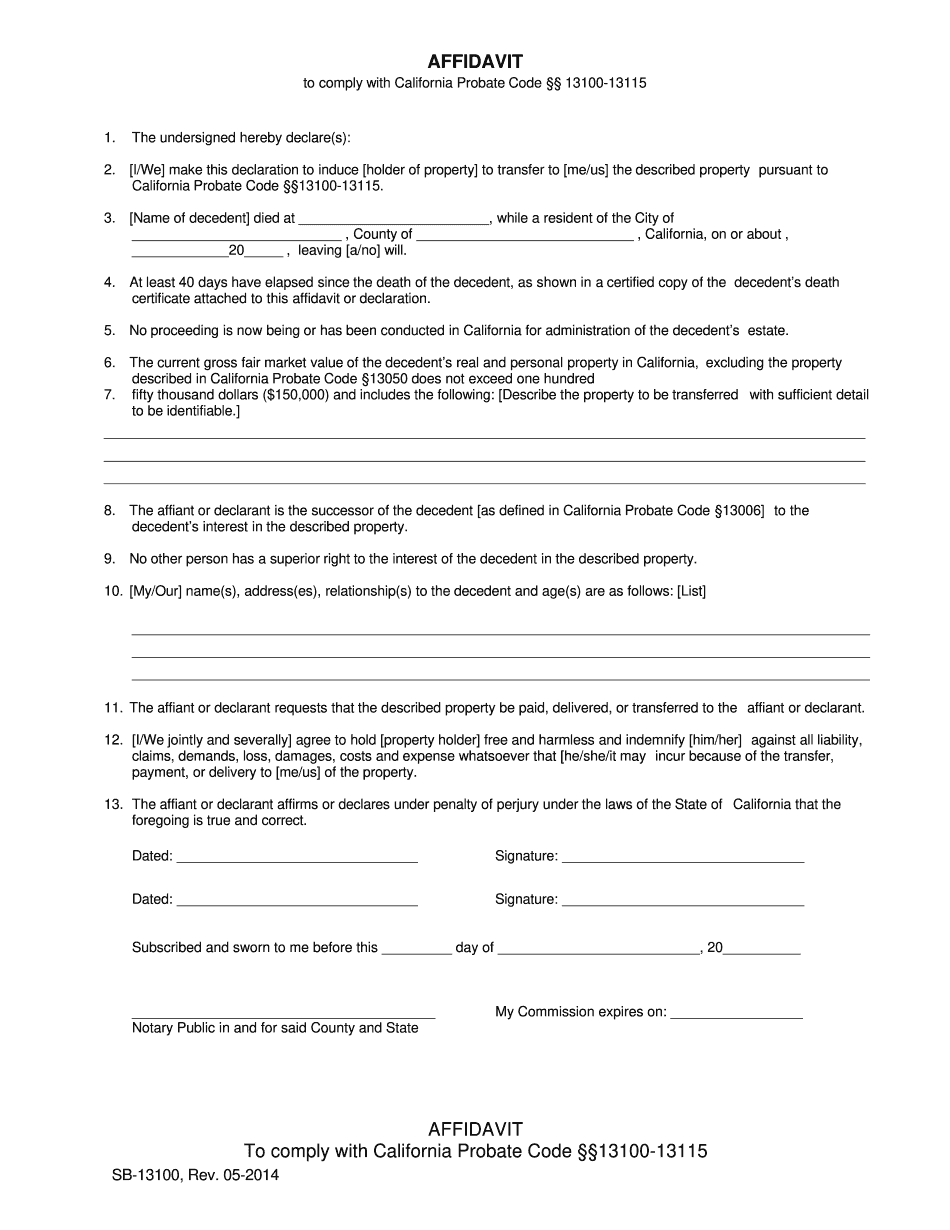

How do i get a small estate affidavit in california Form: What You Should Know

The decedent's name is not located within the deceased's name in any California registry or similar data source. Your use of this information is not for any purpose other than to prepare a certificate showing the date of death of the decedent, which will also contain name, date of birth, sex, height, weight, and current address and place of employment. To register for the service or use of this information, you must provide an appropriate California residential mailing address on the application to be processed. The affidavit will only be used to collect assets in the probate court's name, and for no other purpose. You are not required to complete the affidavit. You can download and print a copy of this form. Fill out and sign Affidavit for Collection of Personal Property State of California In addition to these instructions, if the assets that you want to be taken are valued under 15,000, you must fill out and sign Step 4 of this checklist (not the Step 3 checklist below). If the property is valued above 15,000, do not fill out and sign Step 4. It will be completed, but there will be no value of the property taken that will be considered and entered on the affidavit form due to the fact that the value will be higher. There are other forms in the checklist that may save valuable time, such as the Notice to Appointed Trustee form. In any event, fill out and signs this Affidavit for Collection of Personal Property California Probates In accordance with the federal Self-Invoices Act, you must provide your own self-serve online form to be prepared for a small estate probate or estate tax. An appointment of a representative to collect the personal property of the decedent in probate court is a requirement for filing at the California probate court. If any money will be payable to a representative to be paid by the estate as a liquidated damages judgment or to be paid to an agent in liquidation of a personal estate, the trustee or representative must provide an order for that payment form signed by the representative. Click the link to a Notice to Appointed Trustee form for a self-serve application to use to file a small estate or estate tax application using a representative to collect personal property of the decedent in county probate court.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How do i get a small estate affidavit in california