Another area that's very important is the ability for persons to change their trust. A lot of times, people come to me and they may say, "Okay, the trust is irrevocable, we're stuck." Well, we happen to have a section in our probate codes in California that allows us to actually change an irrevocable trust. I understand how silly that sounds, but it is very important to us because circumstances change. So, if circumstances change and the testator and all the beneficiaries agree that we can change the trust, we don't even have to go to court. We actually have a process that, even if the original testator, the person who created the document, is deceased and the beneficiaries have a reason that this trust needs to be changed, we actually have a process under the probate code to allow us to go into court and present our case. We have a judge rule whether or not we can change it, and usually the judge will allow it if a material purpose or some reason can be presented to the court that shows this trust should be changed. If you think about it, it makes sense. Even though someone may have done something years ago, there's no way they could foresee the future and what would happen. An example being the increase in the exemption. It wasn't that many years ago that the exemption was only a few hundred grand. So, for me to say now, all of a sudden it's eleven point one eight million in 2018 is sort of amazing. To put it in perspective, I know it sounds to me it's not a long time ago, but to a lot of people, it is. In 1976, the exemption was only sixty thousand dollars. So, for it to now be...

Award-winning PDF software

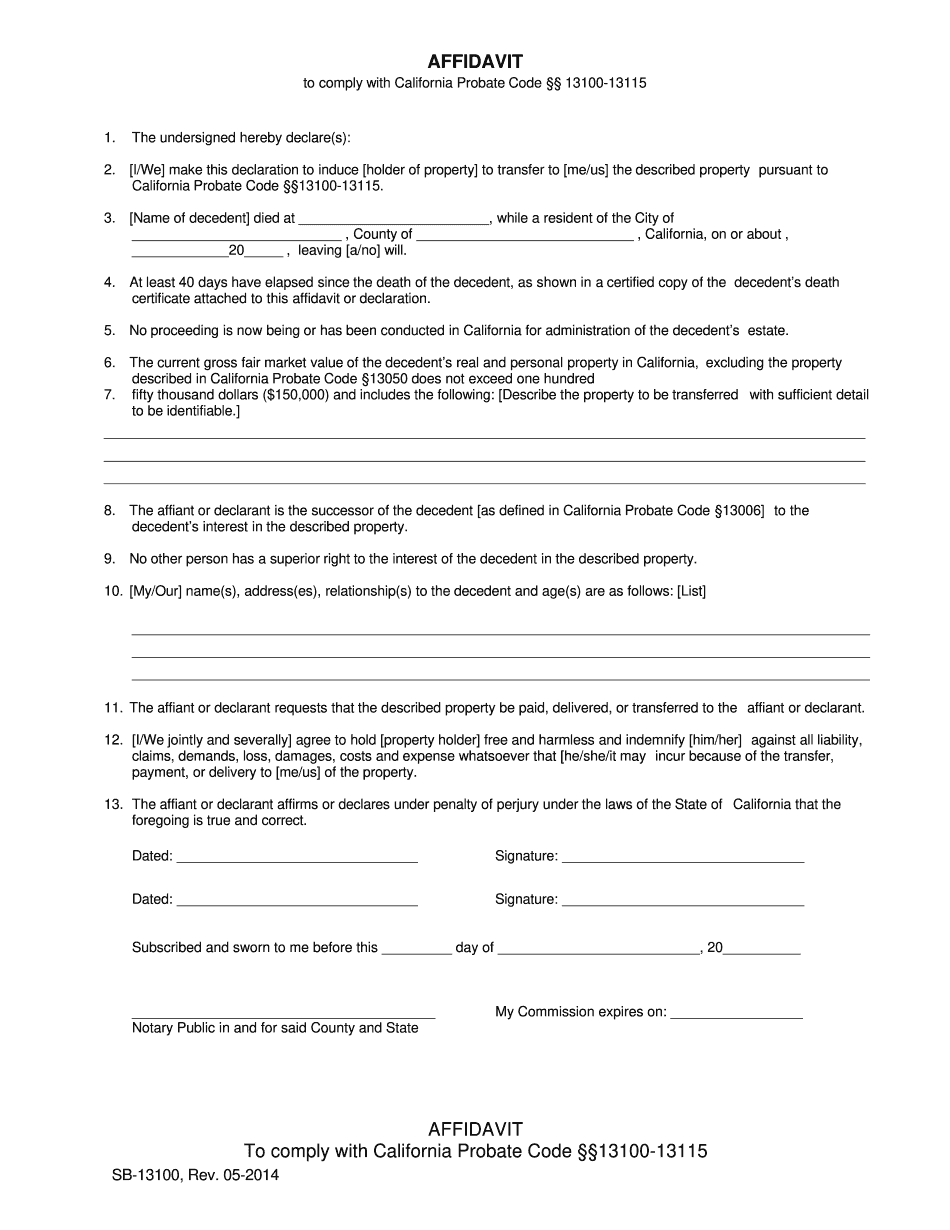

California probate code section 13101 Form: What You Should Know

B) The declaration is not in lieu of a will or will which is executed or filed and recorded under this code, but shall serve for and in lieu of any other record of a will or a valid and subsisting will, including the recording of an executor's declaration. If the decedent's estate includes one or more decedent's personal items, then this declaration is not required under this code to file with the recorder or county clerk of the county in which the property was first acquired, for example, it may serve for and in lieu of an inventory or statement of personal property or a statement of personal remains, a petition or a will and other documents that a recorder or clerk has filed prior to the commencement of the administration. An inventory of personal property may be filed as a will, however, a copy of such inventory must be maintained by each officer in possession of such personal property. If the estate contains gifts, the estate clerk shall prepare an inventory of the gifts, in a manner acceptable to the probate judge. If the estate contains possessions, the evaluator or appraiser of such possessions shall prepare an inventory of these items. C) Each declaration filed under this code shall be signed by the persons signing each portion of the document and the name of each person shall appear on the opposite side of each document. [FN1] [FN1] This is the “affine” format used to ensure the document is legible on the page. It does this by separating the sections with dashes and indenting the spaces between the dashes with a new line. For this reason, the first two paragraphs of the Deal. Of Trust are written vertically and should have no spaces between them. The following paragraph in the Declaration of Trust is formatted to appear along the bottom. There should only be one space under the heading at the bottom. The following paragraph in the Declaration of Trust that follows does not do that, and is formatted to appear above the title of the document. The Declaration of Trust is formatted as a long document.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing California probate code section 13101