Award-winning PDF software

Probate code 13050 Form: What You Should Know

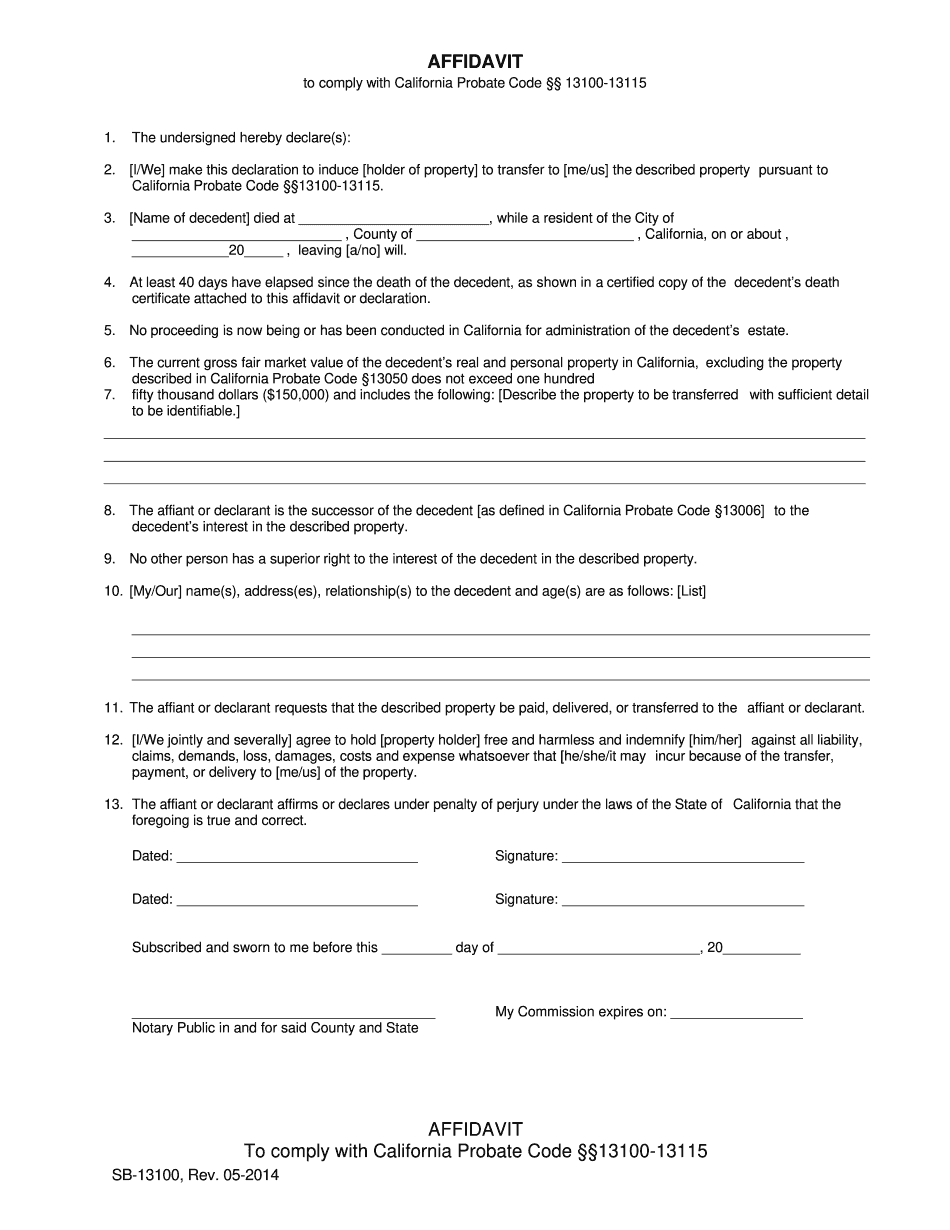

Informal Estate Planning for People with Limited Income (Guide for People with Limited Income: How to Deal with Debts and Finances that may become a Contingent Obligate). The executor of the decedent's estate shall provide an inventory of all property owned and to which the decedent had a legal right to access. The inventory of the decedent includes, but is not limited to, information such as the name and address of each owner, the name, last known whereabouts, and the value of each property owned at the date of death. The probate authorities of the county in which the estate is located shall be notified at the death of the decedent. These probate authorities shall have the authority to order the sale of all properties including and except real and personal property deemed by them to be in need of management. The probate authorities of the county in which the property is located shall review property to be sold and shall not resell any property to a beneficiary or to any other person. (d) The probate court has the authority to take into trust or sell any property owned by the decedent before his or her death. If trust property is sold, the probate court shall make a record of the sale and notify the decedent's beneficiaries and provide a list of property to be taken out of trust. (e) After the value of all property sold pursuant to subdivision (d) exceeds 186,600, property in trust under this part shall be distributed according to this Part. (f) Any estate tax levied after the death of the decedent will be paid by the probate court in the same terms and manner as if the tax had never been levied. Part 3 Property To Be Acquired (1) The executor of the estate shall acquire all property needed to maintain the estate until the end of the probate proceedings, except for a reasonable amount that may be spent on an education for the decedent. (2) The assets will be distributed as follows: (a) If cash is distributed under subdivision (1)(a), the executor shall, after the distribution, pay the cash on the deceased's behalf.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.