P>Music, hello! It's studying. Welcome to our freebie Friday video. Today, I've been asked to talk about how to transfer title from a deceased relative. So, when somebody passes away, usually they either have a will or they don't. In most states, if you have a will, you'll go through the probate process, which is a separate court usually. The court will then sort through all of the assets and debts of the deceased, including the real property. They would issue a deed of distribution to whoever is entitled to the property according to the will. Now, if somebody doesn't die with a will, we have some preset rules for dividing the property up, and that would be called the intestacy rules. Texas has some rules, but usually it's best that you have a will because the intestacy might not divide your property the way that you would have done it if you were alive. When there is no will, that's usually when we get this question. We have to do what we call an affidavit of heirship. The affidavit of heirship is possible if all the heirs are in agreement as to who they are, and if we don't have any unknown heirs out there or if the family is not scattered all over the place. If the person is recently deceased, it's usually easier to trace the family tree back to who's entitled under Texas law. We have to look into the intestacy rules to see who gets what and in what proportion. So, we'll do the affidavit of heirship, saying what exactly the life of that deceased person looked like. We'll mention if they were married, how many times were they married, how many children did they have, and how many children they adopted. Then, we'll look...

Award-winning PDF software

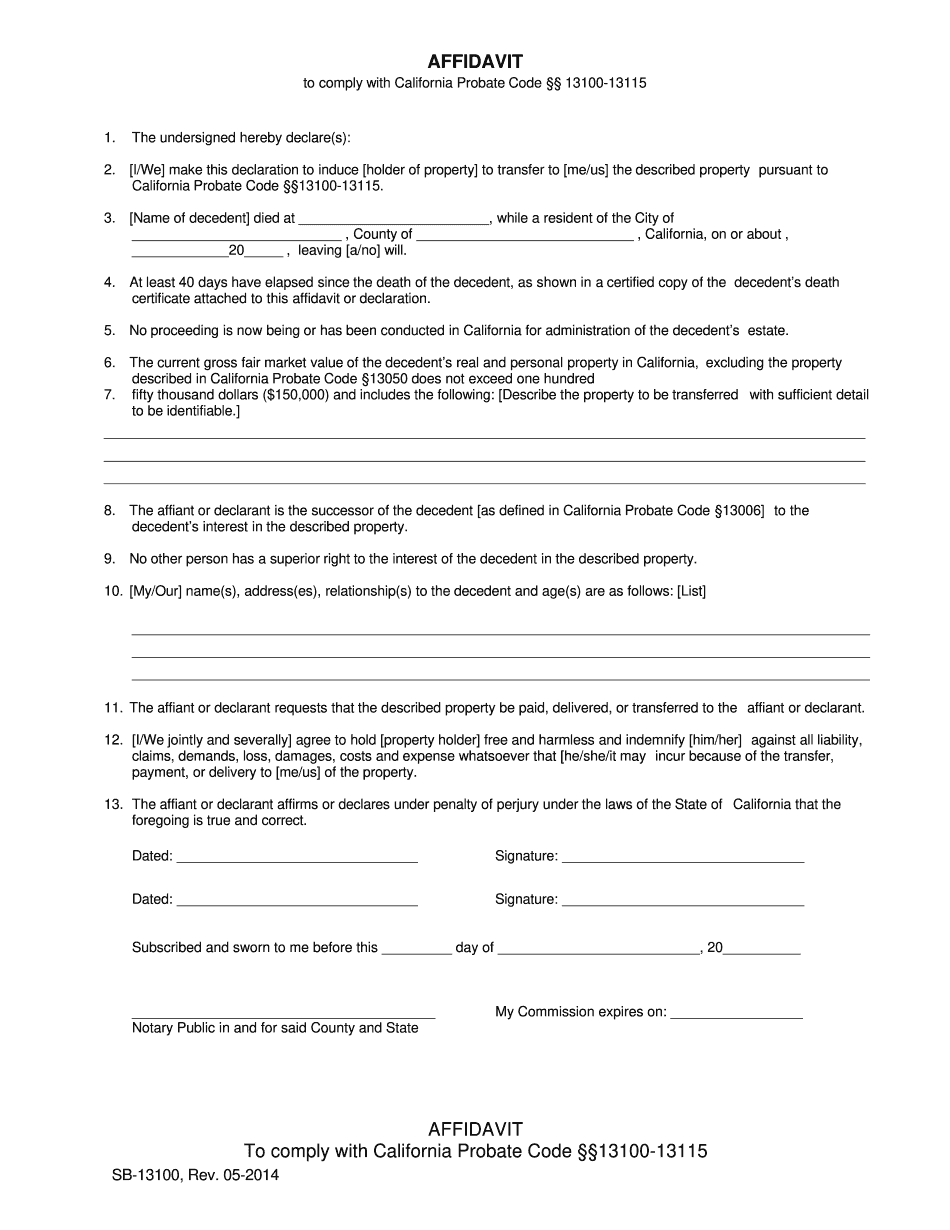

Probate affidavit Form: What You Should Know

The heirs are entitled to the property based only on their ownership of an interest in that property. The free small estate affidavit works like this: After the decedent dies, the heirs must mail a certified copy of a California Probate Petition to Determine Succession, and a certified copy of their estate documents to the California Probate [BWV] Section or to the executor/administrator/administrative agent of the executors or administrators. The executors/administrators are the rightful heirs of the deceased person and must mail the affidavit. In exchange for sending the affidavit, the inheritors are entitled to recover their own interest in the property on the ground that the property was “deprived” by some act by the decedent. The free small estate affidavit can be used during the probate proceedings. However, at no time must the statement be signed by anyone other than the executors or administrators, the heirs of the decedent, or the person on whose behalf the affidavit is made. The free small estate affidavit is not a waiver of the state's right to receive the statement of the heirs and to obtain all other material information required in the probate process (such as the statute of limitations, title searches, or discovery). If your heirs want to be on the same page as the executors and/or administrators, they should draft their own California Probate Petition to Determine Succession to be brought to probate court. There is a fee for the petition.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Probate affidavit