Hi everyone, I'm Attorney Shot Eli Shaffer from the Asset Protection and Elder Law Center. I'm a trust attorney here in Orange County, and I'm also the host of Trust Talk Radio that airs every Sunday at 10 am on 101.5 FM. So please listen to the show, you're going to learn a lot of information on estate planning, and we give a lot of great packets and free stuff out on the radio show. So tune in. Today, I'm going to follow up on the topic of what is probate, what to expect when you have to go through the probate court system. This segment is specifically about all the initial procedures of how you actually start a probate case and probate administration. Generally speaking, you're having to start a probate if, for example, a parent has passed away and they did not have an estate plan, no trust or they only had a will, and the assets are more than allowed. So it has to go and be managed under the probate court system. Many times, two parents will die without a trust or will, so they have no estate planning documents. Again, you're having to probate their assets before you can get access to them. As I mentioned on an earlier episode, probate is basically paying all the debts and creditors out in the estate, and then whatever's left will get distributed to any surviving spouses and the children, the rightful heirs of the individual. Let's just start about how people go about starting a probate case. Generally speaking, a family member will step in. If there's a will, then whoever's named as the executor, generally speaking, will step in and file the initial papers for starting a probate. Often than not, you need an attorney, a probate attorney, to...

Award-winning PDF software

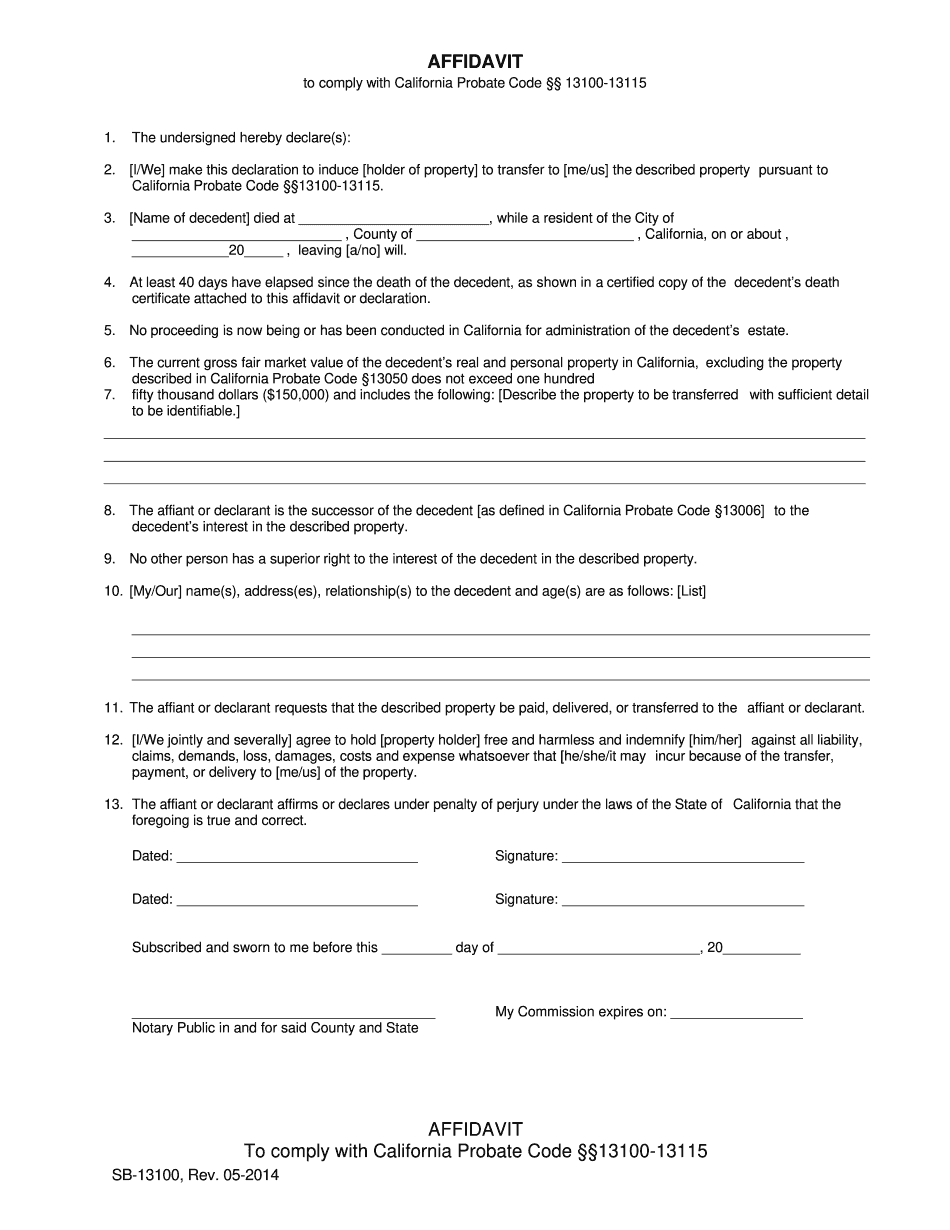

Probate code 13101 Form: What You Should Know

Probate § 13101 (1997). Page 1. 13. The undersigned requests that the described property be paid, Affidavit for Distribution of Personal Property CRC 753:13-7-12. The affidavit of the executor: (A) of the estate in which the decedent resided on the day of his death; or (B) the estate which is subject to intestacy, consisting of his residence, if there is no estate, or if there is one, the residence of the person who signed the decedent's death certificate; or (C) if there is no estate or if there is only one residence, then that residence.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Probate code 13101