Well, when people pass away and leave behind a small estate for their family, it's important that the legal cost be minimal for transferring and inheritance. Attorney Jim Higgins with the Higgins firm recently stopped by to explain the options for keeping costs down for a small estate. Take a look, we've got Jim in fact on the show today and great to have you back, thank you. Alright, we're talking a little bit about passing the inheritance, so what about what happens when someone passes away and maybe they have a small bank account or just a home? Is there an easy way to pass on that inheritance? What do they need to know? There is, you know, that happens a lot. We get calls from people that will say, you know, a beloved parent or loved one passed away and all they had was this one bank account or just a home or something. And so what we try to do is there are certain tools under the law that we can often use to pass that property much cheaper and quicker than going through a full-blown probate estate. The most common situation we see is when they had some old stocks or a bank account. In Tennessee, if the value is under fifty thousand dollars in most situations, we can use a small estate affidavit. We'll draft that affidavit and include certain information about what they had and who the heirs are. This allows the property to be passed much quicker than if it was a full-blown probate estate, and it's obviously cheaper. Another common situation is when somebody has a home. A lot of times, that's all we have when we depart, and that needs to be passed to the heirs. This can often be done...

Award-winning PDF software

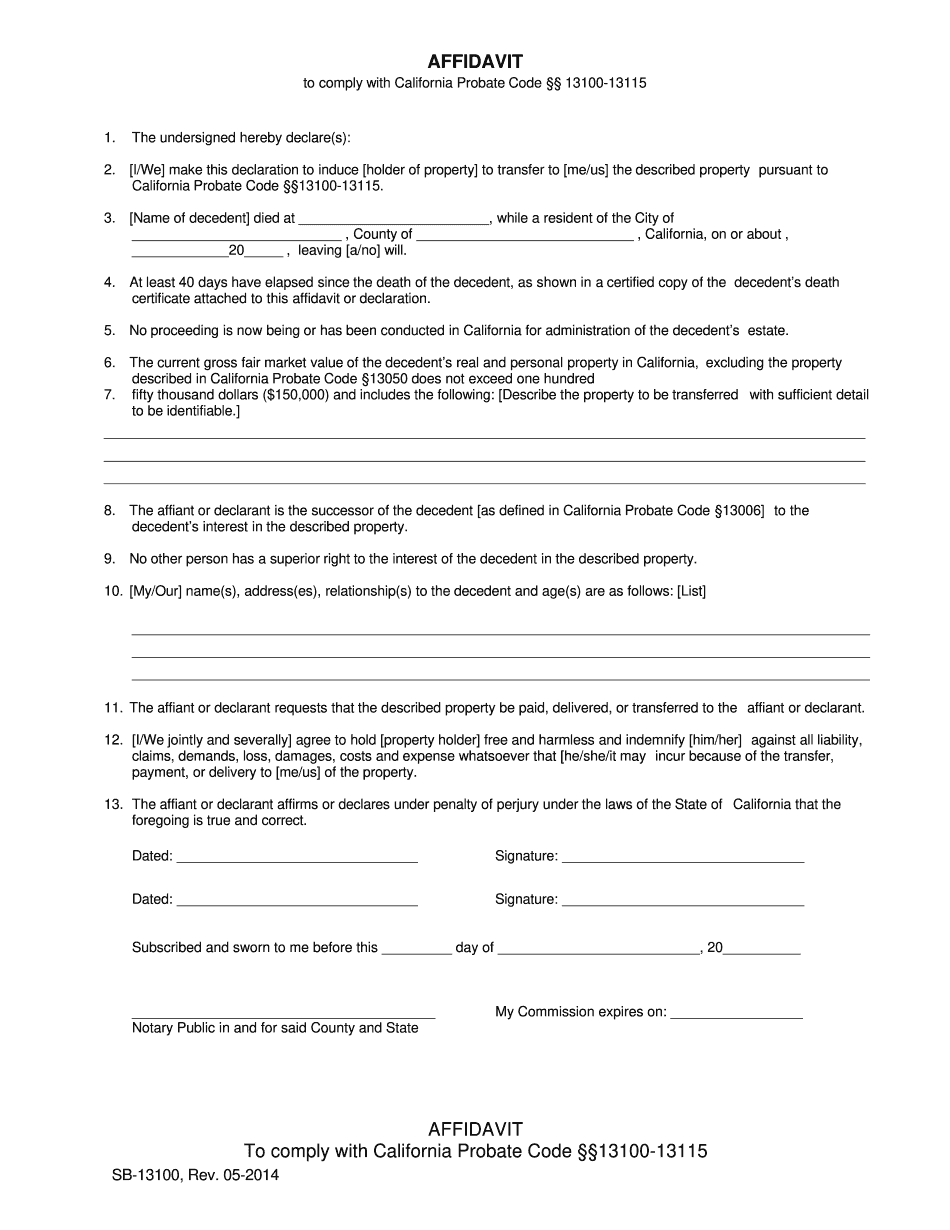

Small estate affidavit california 13101 Form: What You Should Know

It should be noted that California Probate Code Section 13101 is a “statute” which is a codified set of rules which govern the administration of probate proceedings in this state. These rules govern a person who has been appointed to administer an estate in the absence of any adjudication of probate. Cal DAV uses the State of California Register of Deeds to deliver this online document to heirs. Cal DAV will then deliver a California Probate Certificate to the next person whose estate is within the authority of the California Probate Code, or who seeks to declare bankruptcy in the absence of such adjudication. In addition to Cal DAV, there are two other online websites that are useful for reporting on Probate. California Secretary of State For information on estate taxes, the California Department of Justice (DOJ) maintains a website, where you can report your estate tax payments on an annual basis, and receive notices for delinquent taxes.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Small Estate Affidavit California Form 13101