My name is Suzanne McCulloch, and I am a solicitor in the world's trust and probate team at IBB solicitors. There are many things you have to organize when a close relative has just passed away. The priority is to register the death, as you cannot do anything without the death certificate. The death is usually registered by the nearest relative. You should then start making the funeral arrangements and also find out if your relative made a will and who was appointed as executors. The will sometimes contains directions for the funeral. There should be a copy of the will at home, and the original would usually be held by the solicitor or will draftsman, or by the bank. The executors' role is to administer the estate: to obtain probate if that is necessary, close off bank accounts and investments, pay off debts and inheritance tax if any, distribute or dispose of personal effects, and sell or transfer any property. The executor is then responsible for paying legacies and distributing the estate among the beneficiaries named in the will. Executors can be family or friends or a firm of solicitors. Family or friends who are named as executors can also employ a firm of solicitors to administer the estate for them. Probate is basically proving the validity of the will through the probate registry, which is a branch of the courts. To apply for probate, you will need to supply details of all the assets and liabilities in the estate in the application forms. Probate is needed to release the assets of the deceased to the executors. Each organization (bank, building society, etc.) has a different limit above which probate is needed. Usually, this is around £20,000. Joint assets generally pass to the surviving joint owner, and probate is...

Award-winning PDF software

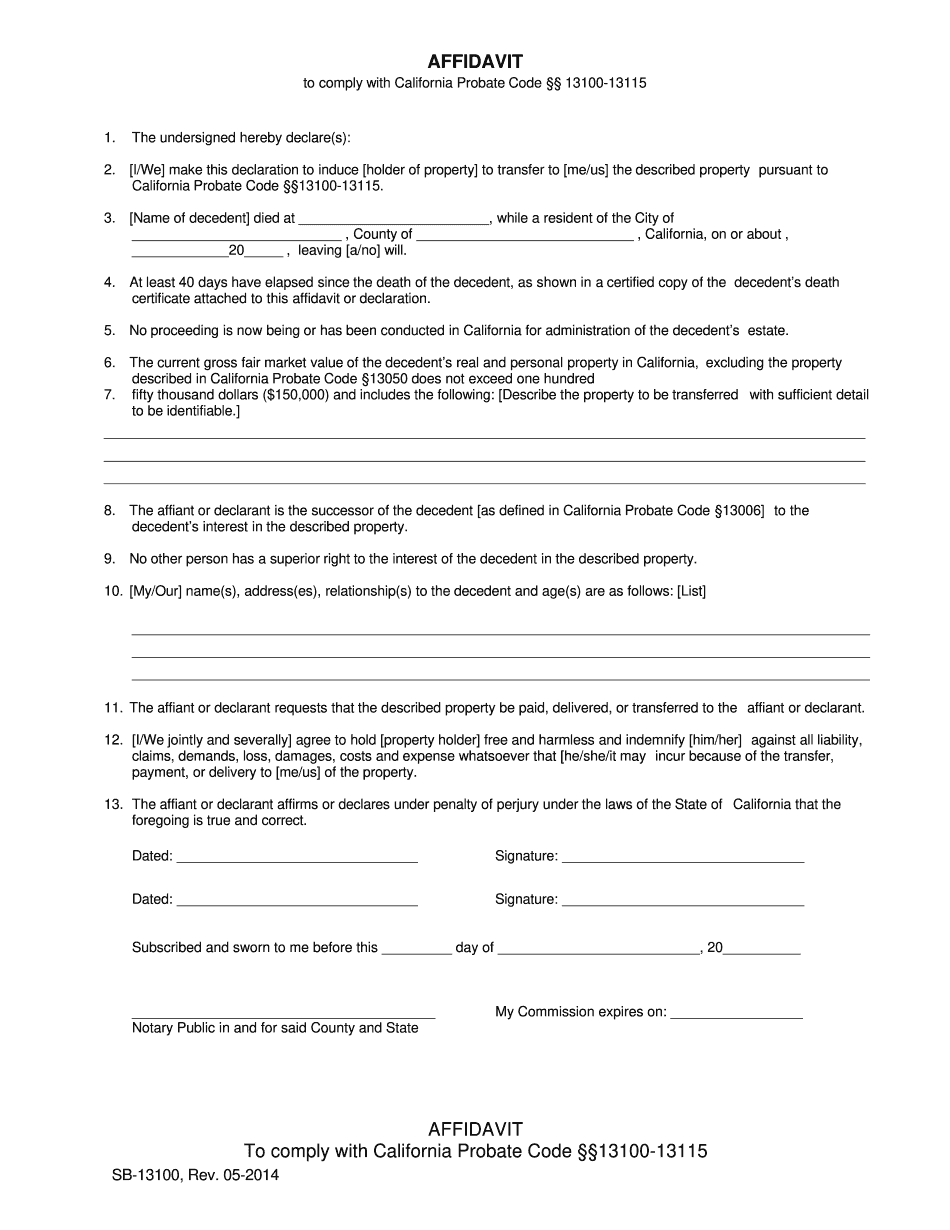

Printable probate 13100 Form: What You Should Know

If the estate does not qualify under California Probate Code Section 13100, the parties will need either a certified copy of death certificate and if there is real estate in the decedent's estate attach a completed Inventory and Small Estate Affidavit or a completed Certificate of Probate for Personal Property (Form PFP-40). You can download and fill out the Certificate of Probate form and send it to the county records' office (s). The California County Clerk's office will submit your request with the other documents. 2. If the decedent and all surviving spouses have a surviving child named as the surviving spouse at the time of death, attach for each surviving child a completed Certificate of Probate. If the decedent and one or more surviving spouses had a child named as the surviving spouse at the time of death, then attach the Certificate of Probate to the Certificate(s) of No Affiliation for Spouse or dependent child(men). You can download and fill out the Certificate of Probate form and send it to the County Clerk's office. The County Clerk's office will submit your request with the other documents. 3. If no surviving spouse is identified or if no surviving children can be identified, attach 1 copy of the Certificate of Probate for the decedent and the original of the death certificate and all supporting documents, if applicable, to the Application for Probate of Minor Or Family. You can download and fill out the Certificate of Probate form and send it to the County Clerk's office. You can attach the original of the death certificate, the certificate(s) of no affiliation with other estates, a certified copy of the Assessment Tax roll, the Certificate/Seal of Administration, the Certificate of Sale/Affidavit, and any documentation related to any other tax (other than the Assessment Tax) from all estates that have existed before your application for probate. You can download and fill out the Certificate of Probate form and send it to the County Clerk's office.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca SB-13100, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca SB-13100 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca SB-13100 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca SB-13100 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Printable Probate Form 13100